[ad_1]

Other than the lower in European exports to China, European exporters additionally face a weakening of gross sales to different Asian markets, which demand extra subtle and high-value-added pork merchandise.

In 2023, Japan and South Korea had been affected by vital inflation. Within the third quarter, client meals costs rose by 9.4% in Japan and by 4.5% in South Korea in comparison with 2022. This unsure financial context has led to a drop in client demand, particularly within the restaurant trade, a sector that requires imported merchandise.

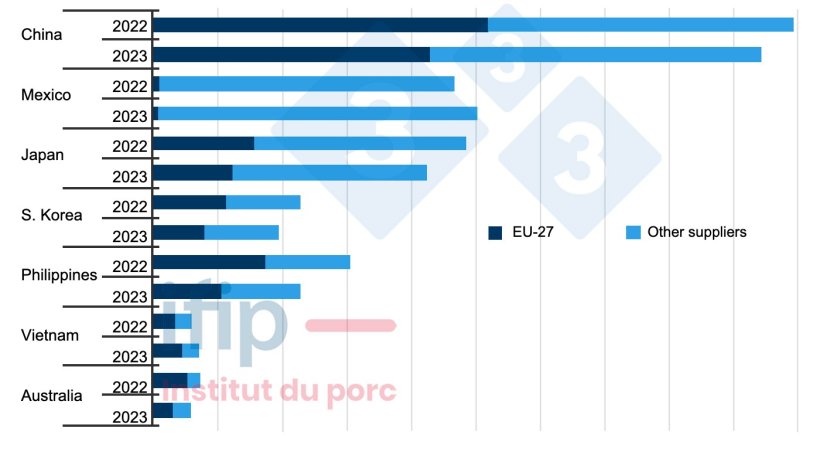

This is the reason within the first eight months of the 12 months, imports of pork merchandise fell by 12.5% year-on-year for Japan and by 14.1% for South Korea. Europeans had been the toughest hit by the weakening of purchases from these two markets. Alternatively, Brazilian exporters, which beforehand had little presence in these Asian international locations the place demand for processed merchandise is stronger than in China, gained market share.

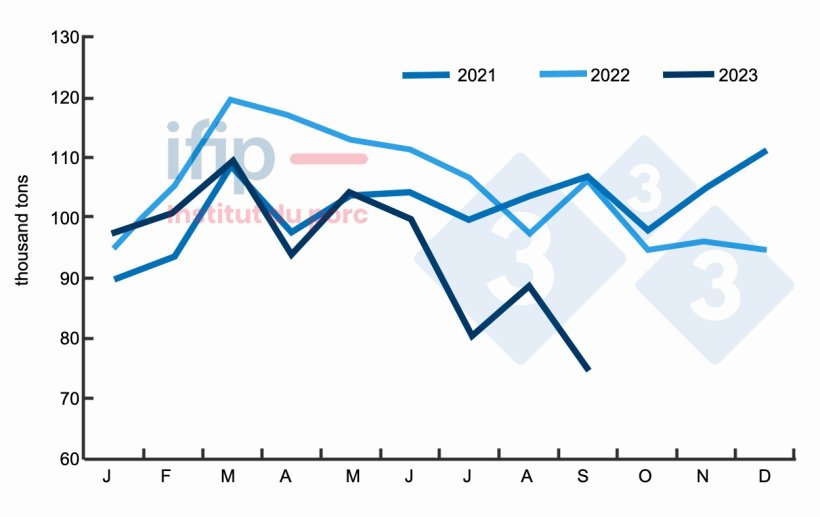

Japanese imports (thousand tons; excluding stay pigs). Supply: IFIP based mostly on Eurostat customs knowledge, TDM.

In 2023, the export market was marked by the lack of European market share in lots of international locations, competing with Brazilian and American origins.

On the root of the EU’s lack of competitiveness are worth variations between producing areas and the lower in European manufacturing. This context is compounded by an unfavorable financial surroundings for purchases by the principle world importers, which slowed world commerce within the third quarter.

Outdoors Asia, progress drivers for European exporters are restricted as a result of they profit little from the dynamism of Mexican demand. America accounts for 83% of Mexico’s provide, adopted by Canada (13%), Brazil (2%), and at last Spain (1%). In Australia, demand has fallen (-21%) and solely European volumes are affected (-45%). Different suppliers are consolidating their positions (+41%), particularly the USA.

Regardless of the autumn in European pork manufacturing, the export market is responding to the problem of balancing carcasses and the valorization of all pork merchandise. Just like the Brazilians and the People, European exporters are exploring a vital diversification of their markets outdoors Asia or Latin America.

Main world importers and their suppliers (1000’s of tons; excluding stay; cumulative 9 months). Supply: IFIP in line with Eurostat customs, TDM.

[ad_2]