[ad_1]

UK pigmeat import volumes continued to extend in the direction of the tip of final 12 months, because the EU-UK worth differential grew, making imports a beautiful proposition to full home shortfalls.

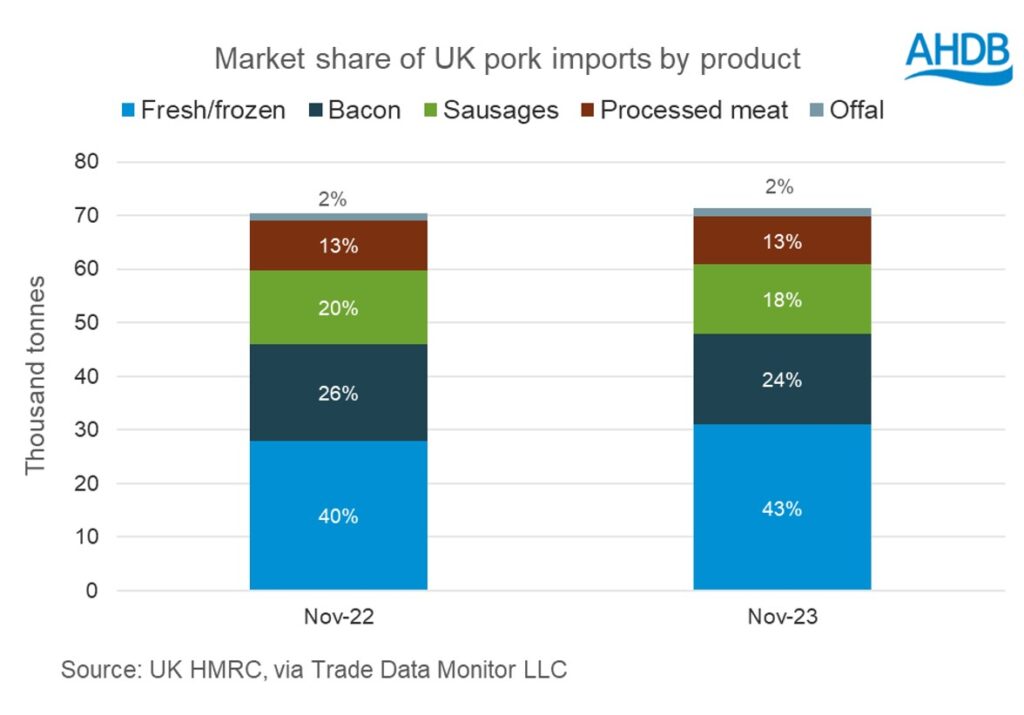

Pigmeat import volumes totalled 71,300 tonnes in November, up by 1,200t on October, the fourth month in a row of development and 1,000t up on November 2022.

For the 12 months to November, UK pig meat imports totalled 720,100 t, which was 2% (-18,100t) down on the identical interval in 2022. Nonetheless, each month from Could has seen a year-on-year improve.

Throughout November, imports of contemporary and frozen pork have been 11%, 3,000t, up on November 2022. Nonetheless, sausage imports have been down 7%, 1,000t, bacon was down 5%, 900t and processed pork merchandise have been 3% decrease.

AHDB senior analyst Soumya Behera mentioned ‘a number of elements’ are contributing to the rise in import volumes, together with decrease home manufacturing, with the UK pig inhabitants recorded at its lowest degree in over a decade.

“Decrease European pig reference costs, which have been declining over the previous couple of months, additionally stay key,” she mentioned.

“The worth differentials between UK and EU costs proceed to help EU imports to the UK. Along with this, demand elements have additionally performed a key function.

“Retail quantity purchases stay suppressed by 2.2% for the 12 weeks ending 26 November 2023. Nonetheless, volumes within the meals service sector have gone up by 7.2%, thereby uplifting demand in a class with larger publicity to imported product.”

Exports

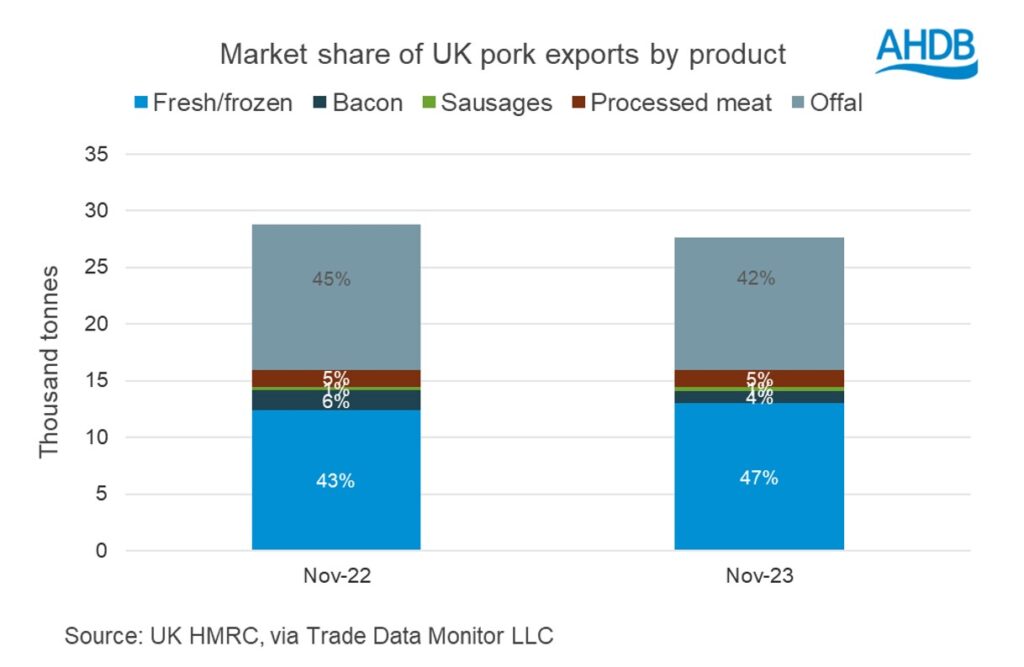

UK pigmeat export volumes remained beneath 2022 ranges, due largely to manufacturing constraints, totalling 27,600 t in November, down 4% (-1,200 t) on November 2022.

Whole pig meat exports 12 months to November) totalled 275,900t, one of many lowest volumes within the final eight years and 19% decrease (-65,700 t) in comparison with the identical interval final 12 months.

All product classes noticed year-on-year declines in November – aside from contemporary/frozen pork, the place volumes have elevated by 600 t. Shipments of offal have seen the most important quantity declines, down 9% year-on-year to 11,700 t.

Exports of bacon have recorded a decline of 600 t (36%), whereas exports of sausages and processed meat recorded small modifications.

Although exports to China, one of many main consumers of offal, have developed within the final two months, volumes proceed to pattern nicely beneath earlier years.

Whole exports to China have been recorded at 10,800 t in November, representing 39% of the full export volumes, however 2%, practically 300t, beneath November 2022 ranges.

Shipments to EU-27 locations declined by 1,100 t to 12,000 t in November in comparison with a 12 months in the past. The most important declines throughout the EU have been seen in shipments to Netherlands and France.

“The numerous discount in home manufacturing as talked about above will probably be an element behind this variation. The hole between UK and EU pricing continues to make UK product much less aggressive on the EU market,” Ms Behera added.

“Demand stays challenged with customers taking a cautious method. Provides accessible within the main exporting areas, home manufacturing and worth factors will probably be key as we glance out throughout 2024.”

[ad_2]